How Cake Equity's Platform is Revolutionizing Startup Capital Management Globally

Who is Jason Atkins?

Jason Atkins, co-founder and president of Cake Equity, hails from Gold Coast, Australia, and holds a Bachelor of Commerce in Accounting and Finance from Griffith University. With an extensive background in finance, including roles at Mastercard and as CEO of several companies, Jason utilizes his insights from the startup ecosystem to simplify equity processes for founders globally.

What problem does Cake Equity solve?

Cake Equity simplifies the complex maze of startup equity management, helping entrepreneurs effortlessly allocate ownership, attract talent, and streamline capital raising—saving time and reducing costly legal mistakes.

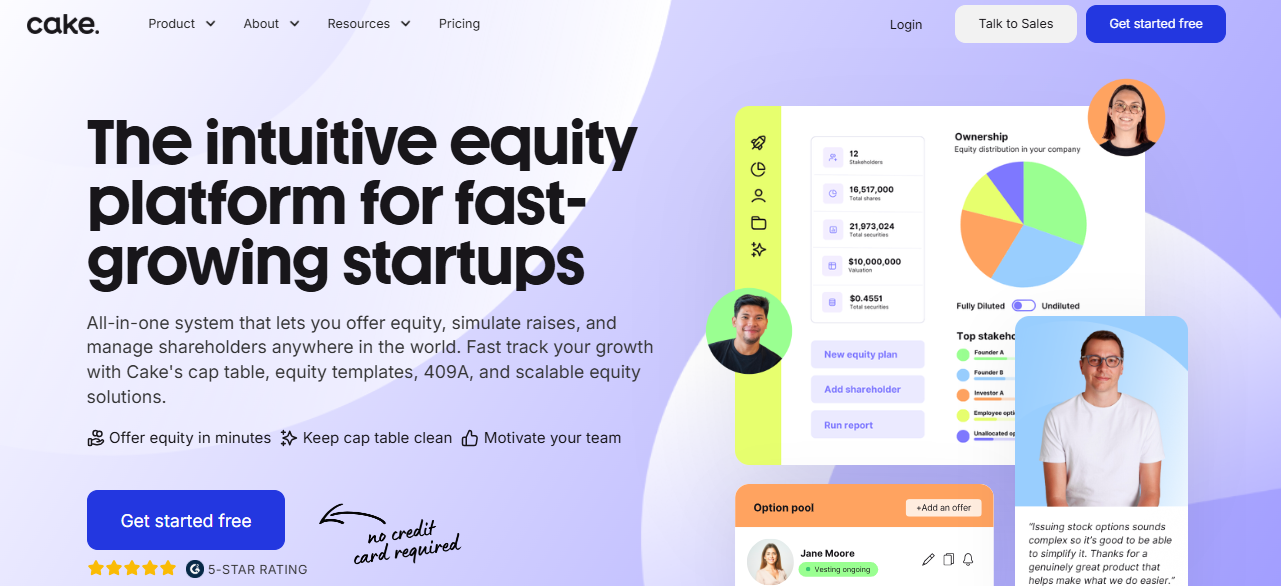

Cake Equity Homepage

How did Jason come up with the idea for Cake Equity?

Kim Hansen and Jason Atkins, the co-founders of Cake Equity, identified a significant problem through their personal experiences with startups and equity complications. They noticed that many founders faced repeated issues when dealing with equity due to its complexity. This led them to the realization that there needed to be a simpler and more standardized approach to managing equity, especially for startups who often lack the resources to navigate these challenges efficiently.

They conducted grassroots research, speaking with potential customers and engaging with key figures in accelerators to validate the need for a streamlined solution. Consistent feedback highlighted a painful and manual process, reinforcing their belief in the necessity of creating a simplified platform. This feedback loop helped them refine their initial concept into a solution that could automate and organize equity management, saving both time and cost for startup founders.

Throughout the ideation process, they encountered the challenge of integrating legal and regulatory compliance into a tech solution without overwhelming users. By breaking down the equity process into standardized, digital workflows, they managed to overcome this obstacle, learning a crucial lesson about the importance of aligning legal frameworks with user-friendly technology. Their experience illustrates the importance of addressing a genuine need with empathy and creating a product that simplifies a traditionally complex area for users.

How did Jason Atkins build the initial version of Cake Equity?

To build Cake Equity, founders Kim Hansen and Jason Atkins focused on overcoming the intricate legal and technical challenges of equity management. They initiated the process with extensive grassroots research, speaking to 30 prospective customers to deeply understand the prevalent pain points, such as costly and time-intensive capital raising and equity management. Initially, they experimented with blockchain technology for equity transitions but quickly pivoted to streamline traditional equity processes after realizing blockchain's inherent challenges and market readiness. This pivot led them to develop a product that standardizes legal documents, digitizes workflows, and integrates essential entities like regulators, thereby creating a comprehensive, one-click global equity platform. The transition from an initial concept to a functioning SaaS product took significant effort in automating legal compliance and forming legal agreements, reflecting the complex nature of the process. Despite these challenges, Cake Equity emerged as a critical tool for startups to engage teams and investors with unprecedented simplicity and efficiency.

What was the growth strategy for Cake Equity and how did they scale?

Partnerships

Cake Equity has strategically formed partnerships with accelerators and investors to broaden its reach and credibility. By engaging closely with entities like Startmate and River City Labs, Cake Equity positions itself as a trusted partner in the startup ecosystem. These partnerships allow Cake to tap into a network of startups that need streamlined equity management, effectively increasing its customer base.

Why it worked: Establishing relationships with accelerators and investors helps build credibility and provides access to a steady stream of potential clients, particularly startups that require legal and organizational support in equity management.

Product-Led Growth

The company's approach emphasizes creating a product that's easy to adopt, requiring minimal manual intervention from the customer side. Cake Equity's product simplifies complex equity processes through an intuitive platform, which encourages easy adoption and increases customer retention through self-service capabilities.

Why it worked: By making equity management more approachable and reducing the customer effort needed to utilize the platform, Cake Equity facilitates a deeper adoption of its product in businesses, fostering long-term usage and customer loyalty.

Referrals and Word-of-Mouth

Cake Equity relies on the virality of its product, where current users and investors recommend it to other startups within their networks. As investors use the platform to manage equity and cap tables, they often suggest Cake Equity to other companies in their portfolios.

Why it worked: When a product effectively solves a significant pain point, satisfied customers naturally become advocates. This organic promotion is powerful as it stems from trusted sources within the industry, enhancing Cake Equity's reputation and reach without incurring additional marketing costs.

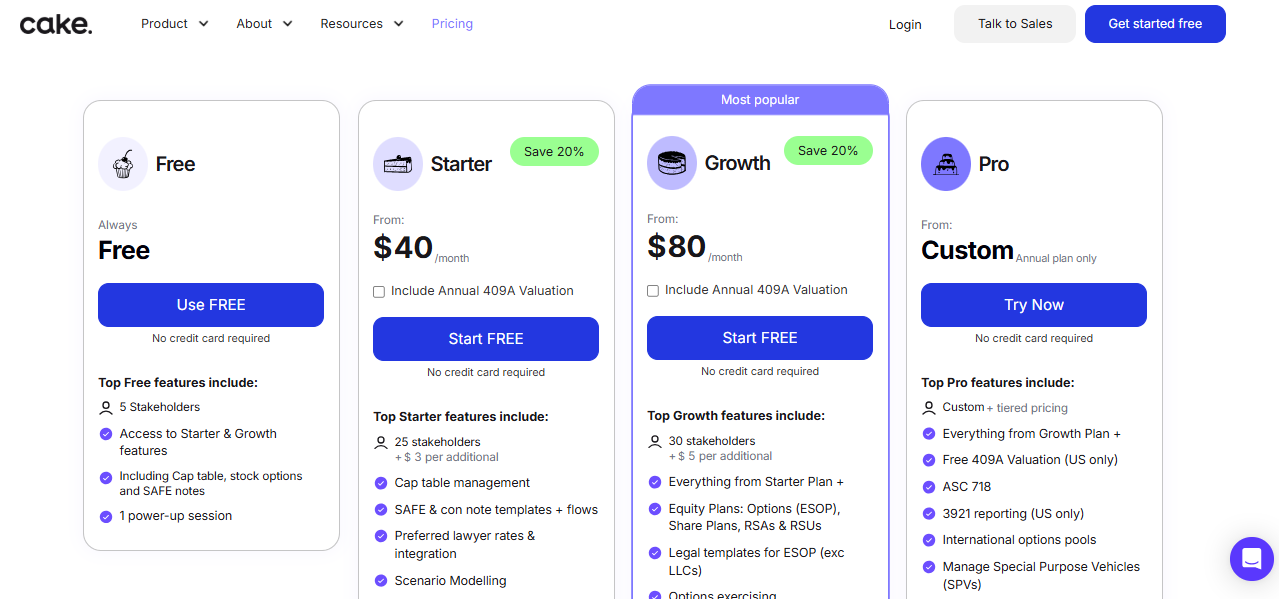

Freemium Model

The introduction of a freemium model allows startups to begin using Cake Equity without barriers, enabling them to experience its benefits before committing financially. This model lowers the entry threshold for new users, who can later convert to paying customers as they scale and need more comprehensive features.

Why it worked: By allowing potential clients to try before they buy, Cake Equity reduces the risk for startups and eases them into using the platform. Once the startups grow and need additional functionalities, they are more likely to transition to a paid plan, thereby monetizing the freemium users.

What's the pricing strategy for Cake Equity?

Cake Equity employs a SaaS pricing model with a free tier and subscription plans, allowing startups to manage equity, cap tables, and employee options efficiently.

Cake Equity's Pricing

What were the biggest lessons learned from building Cake Equity?

- Standardize and Simplify: Cake Equity learned that by standardizing documents and digitizing processes, they reduced the complexity and time involved in equity management for startups. This change made capital raising more accessible and efficient.

- Adapt and Pivot: The company successfully pivoted from focusing on blockchain to addressing traditional equity challenges after customer research highlighted persistent pain points. This shift was critical to their market success.

- Culture of Ownership: By emphasizing equity ownership, Cake Equity fostered a strong culture of engagement and retention among their team. Employees felt personally invested in the company's success, demonstrating the power of employee equity in building team solidarity.

- Global Reach with Local Insights: Expanding into new markets requires understanding and adapting to local nuances. Cake Equity found success by sending team members to target markets and adjusting their product and messaging to fit regional expectations and laws.

- Focus on Mission and Purpose: Cake Equity's commitment to making equity simpler for startups aligned with their broader mission to democratize entrepreneurship. This clear mission guided strategic decisions and reinforced their brand identity, engaging both their team and customers deeply.

Discover Similar Business Ideas Like Cake Equity

|

|

Idea

|

Revenue

|

|---|---|---|

|

ProjectionHub

|

"Financial projection templates for startup fundraising success."

|

$61K

monthly

|

|

Apps:Lab

|

"Custom software solutions for businesses and communities."

|

$6K

monthly

|

|

Coinpanda

|

Cryptocurrency tax and portfolio tracker platform.

|

$35K

monthly

|

|

Buxfer

|

"Buxfer: Budgeting app for finance power users."

|

$50K

monthly

|

|

HollaEx

|

Open-source software for launching customizable crypto exchanges.

|

$35K

monthly

|

|

Akurateco

|

White-label payment platform for fintech companies.

|

$100K

monthly

|

|

MintMe

|

"Ecosystem for creating and trading custom digital tokens."

|

$10K

monthly

|

More about Cake Equity:

Who is the owner of Cake Equity?

Jason Atkins is the founder of Cake Equity.

When did Jason Atkins start Cake Equity?

2018

What is Jason Atkins's net worth?

Jason Atkins's business makes an average of $/month.

How much money has Jason Atkins made from Cake Equity?

Jason Atkins started the business in 2018, and currently makes an average of .

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.