3 Merchant Wallet Account Success Stories [2025]

Think of a place where you can keep your business's money safe, organized, and always ready for transactions. That's the essence of a merchant wallet account.

A merchant wallet account is a digital wallet specifically designed for businesses to manage their financial transactions with ease. It functions almost like a traditional bank account but offers additional benefits such as instant payments, low transaction fees, and seamless integration with online marketplaces.

Whether you’re running a small e-commerce store or a large online marketplace, having a dedicated merchant wallet account can streamline your financial operations. You'll find it much easier to handle multiple payment methods, reconcile accounts, and offer swift refunds to your customers.

Why should you consider this idea? It’s about efficiency and control. By simplifying how you manage money, you free up more time to focus on growing your business. Start with a merchant wallet account and watch your operations become smoother and more reliable.

In this list, you'll find real-world merchant wallet account success stories and very profitable examples of starting a merchant wallet account that makes money.

1. shurjoPay ($24M/year)

Fida Haq, the MD and CEO of shurjoPay, came up with the idea for the online payment gateway in 2009 while managing an ATM network in Bangladesh. Recognizing the challenges faced by the e-Commerce sector in the absence of a local payment gateway, Haq decided to create shurjoPay to facilitate online payment collection for merchants. Since its launch, shurjoPay has become a key player in the industry, averaging a transactional volume of $1.5 million per month with over 600 merchants onboarded.

How much money it makes: $24M/year

How many people on the team: 150

Bangladeshi MD and CEO Fida Haq established shurjoPay in the e-Commerce sector in 2010, a payment gateway as a merchant service provider so MSMEs could accept online payments in a country that lacked such a solution; now averaging $1.5M in transactions per month with 600 merchants, and expanding services with QR-based payments and payment links.

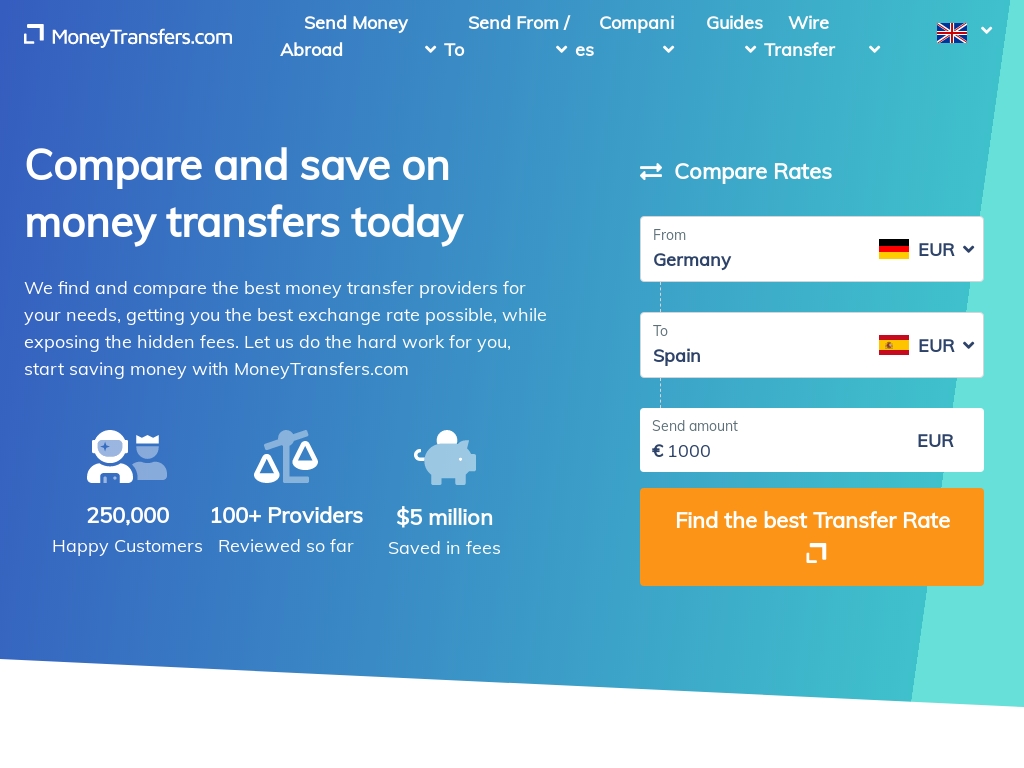

2. MoneyTransfers.com ($138K/year)

Jonathan Merry, founder of MoneyTransfers.com, came up with the idea for his business after experiencing the confusing and opaque world of online remittances firsthand. He realized there was a gap in the market for a money transfers comparison site that would provide users with transparent and affordable options. Since its launch in 2019, MoneyTransfers.com has generated an average monthly revenue of £2.5m and has become a trusted brand in the industry.

How much money it makes: $138K/year

How many people on the team: 12

MoneyTransfers.com is a comparison website which has grown to generate average monthly revenues of £2.5m and 2,500 new customers for partners each month since founder Jonathan Merry took the plunge in 2019; despite only experiencing organic acquisition in the last year, the company's solid traffic and range of digital PR campaigns aimed at the expat community have contributed to the company's establishment as a trusted brand in the money transfers space.

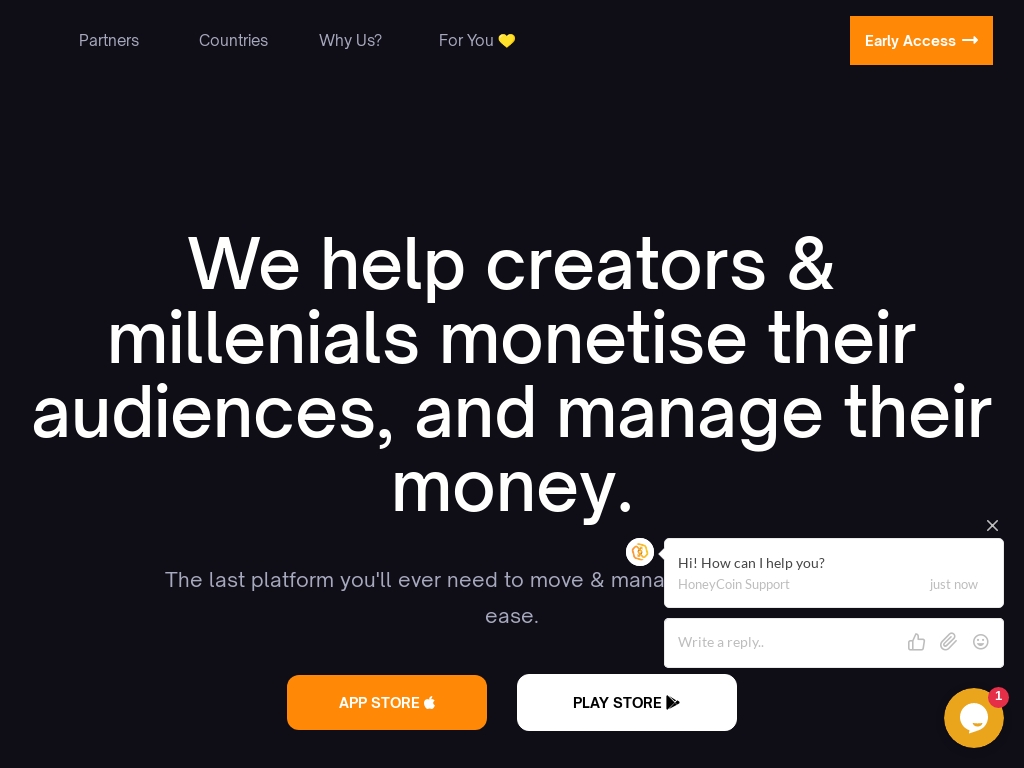

3. HoneyCoin ($12K/year)

David Nandwa founded HoneyCoin after experiencing frustration with payment platforms that were expensive, had restrictions for young people, and had unfriendly user experiences. He also saw the potential for independent creators in Africa to make significant earnings and wanted to create a platform that catered to their needs. HoneyCoin is now profitable and will be raising capital to handle increased demand after its public launch.

How much money it makes: $12K/year

How much did it cost to start: $150

How many people on the team: 0

HoneyCoin is a payments app that helps creators and internet businesses monetize their audiences by managing cash and cryptocurrency all in one place, which processes an average of $10k per month in revenue and has onboarded 504 people.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.