Cryptocurrency Payment Facilitating Business Success Stories [2025]

Cryptocurrency is changing how we handle money, and a business facilitating cryptocurrency payments might be your next venture. Essentially, you're creating a platform to help businesses accept payments in various cryptocurrencies, making transactions seamless and secure.

Setting up this business means developing or integrating software that converts digital currencies into fiat ones, handling conversion rates, and ensuring compliance with regulations. The need for secure, fast, and cost-effective transactions keeps growing, and businesses are looking for reliable solutions.

The complexities are real—managing security risks, staying updated with legal requirements, and educating clients on the benefits of cryptocurrency. However, the demand for cryptocurrency payment systems is rising, and being at the forefront of this financial evolution could be both lucrative and fulfilling. Consider it if you enjoy navigating the ever-evolving world of digital finance.

In this list, you'll find real-world cryptocurrency payment facilitating business success stories and very profitable examples of starting a cryptocurrency payment facilitating business that makes money.

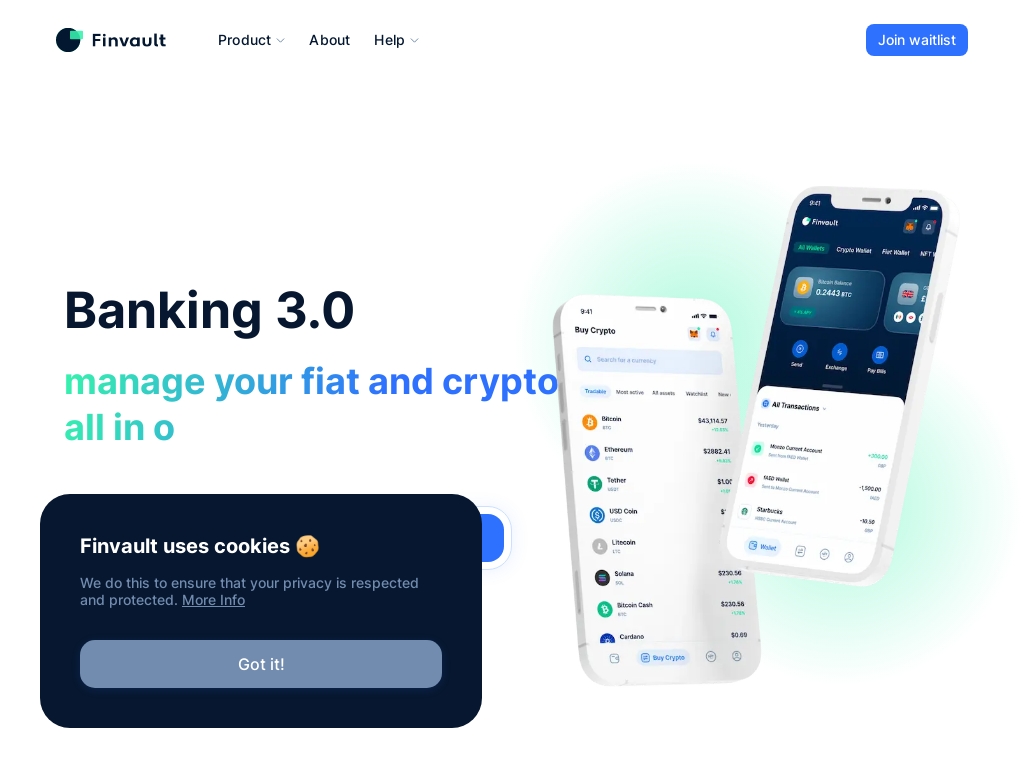

1. Finvault ($2.64M/year)

Punit Thakker, the CEO and co-founder of Finvault, came up with the idea for the digital wallet after recognizing the need to bridge the gap between traditional finance and decentralized finance (DeFi). With a background in fintech and cybersecurity, Punit and his co-founder Christian Papathanasiou aim to create an equitable financial ecosystem by providing a platform that allows users to manage all their bank accounts and crypto in one place. They have built a skilled team of developers and designers to bring their idea to life and are preparing for a phased launch into the UK and European markets.

How much money it makes: $2.64M/year

How much did it cost to start: $700K

How many people on the team: 13

Finvault co-founder Punit Thakker discusses the digital wallet's mission to financially connect users worldwide by providing one platform to manage all bank and crypto accounts; the platform is due to launch with initial features, including a crypto exchange, and is projected to achieve a customer acquisition cost of $10.75 and lifetime value of $4,800 based on a two-year lifecycle assumption.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.