How Float's Cashflow Forecasting App Revolutionized Business Growth Strategies

Who is Colin Hewitt?

Colin Hewitt, the founder of Float, hails from Belfast, Northern Ireland and later moved to Edinburgh, Scotland. Originally operating at the intersection of design and technology, Colin's entrepreneurial journey began with a digital agency before shifting his focus to cash flow management, spurred by his personal experiences with financial stress and a need for better financial solutions.

Colin Hewitt, the founder of Float

What problem does Float solve?

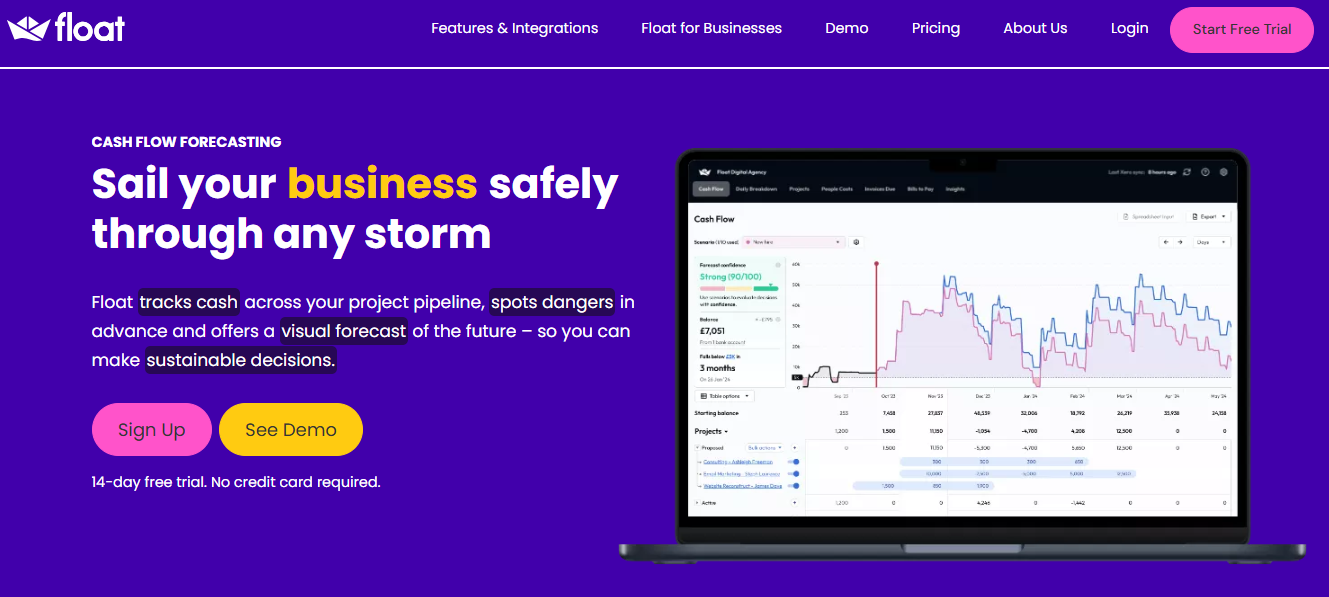

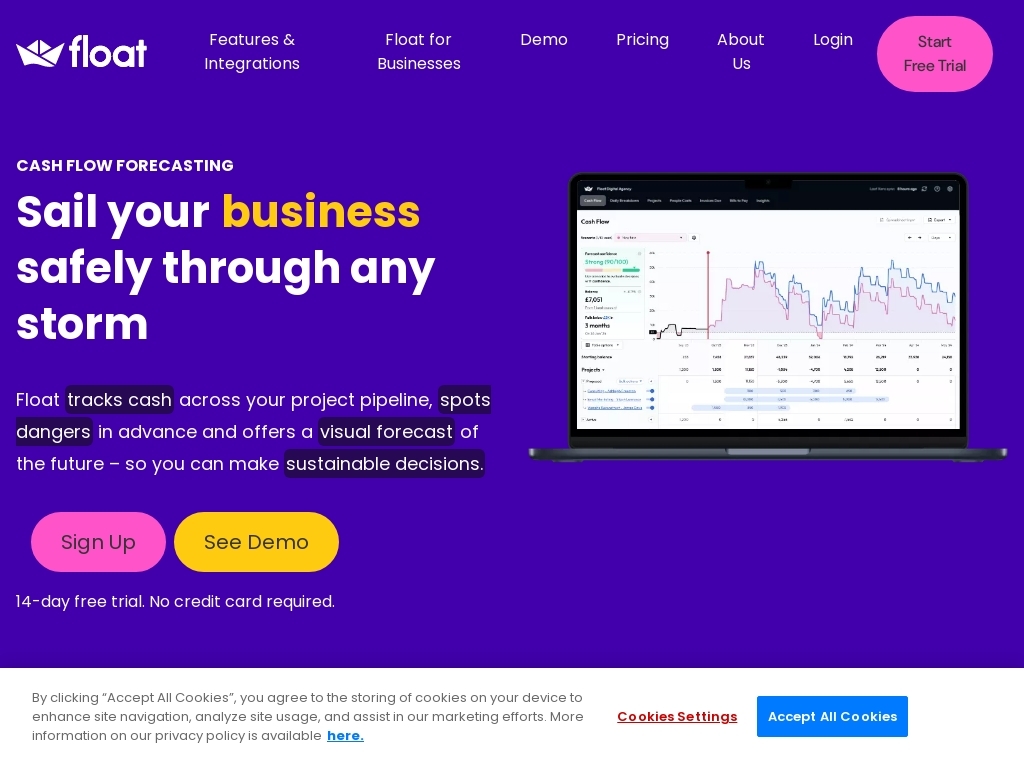

Float helps small business owners eliminate the stress of unclear cash flow by providing an easy-to-use forecasting tool, so they can confidently manage finances without losing sleep over unexpected shortfalls.

Float App Homepage

How did Colin come up with the idea for Float?

Colin Hewitt's journey to creating Float began during his time running a digital agency, where he frequently encountered the stress of managing cash flow. He recognized early on how vital cash management was for making crucial payroll and operational decisions. This realization came from personal experience; as the agency grew, so did the complexity of financial planning, pushing Colin to seek better systems beyond the fragile spreadsheets he initially relied on.

His initial step was to create detailed spreadsheets to better understand financial inflows and outflows, but these proved to be labor-intensive and prone to errors. Colin realized that accessing real-time data from accounting software could vastly improve accuracy and efficiency. This insight prompted him to leverage cloud accounting platforms, allowing API integrations to streamline financial data management, reducing manual entry, and improving forecasting.

Before fully committing to Float, Colin validated his idea by observing firsthand the critical gap in cash flow management for small businesses, exacerbated by the limitations of traditional accounting systems. He tested his problem-solving approach within his agency, gaining clarity and control that wouldn’t have been possible with spreadsheets alone. His journey underscores the importance of aligning tech solutions with ongoing financial challenges, a lesson that shaped Float into a trusted forecasting tool for many businesses today.

How did Colin Hewitt build the initial version of Float?

Float, the cash flow forecasting software, was initially built by integrating data from accounting systems using APIs that allowed seamless data transfer into a spreadsheet-like interface. The development process began with a focus on extracting bank transactions, open invoices, and journals from software like Xero, QuickBooks Online, and Free Agent. Colin Hewitt, the founder, emphasized simplicity and ease of use for non-financial users, leveraging cloud accounting advancements to automate real-time data synchronization.

The first prototype took shape as Hewitt utilized personal experience from using spreadsheets to monitor financials, which later evolved into a polished app over several years, benefiting from ongoing customer feedback and iterative testing. Development challenges included ensuring the software offered reliable, day-to-day cash flow insights, which required sophisticated data handling and user-friendly visualization tools. Building this product involved a substantial commitment of resources and strategic hiring, such as bringing in a dedicated CTO, to refine technical capabilities and adapt to user needs.

What was the growth strategy for Float and how did they scale?

Partnerships with Accounting Platforms

Float integrated with major cloud accounting software like Xero and QuickBooks Online, which allowed them to tap into an existing customer base that already uses these platforms. They offered a seamless way for users to incorporate cash flow forecasting into their accounting process without duplicating data entry. This integration not only expanded their user base significantly but also positioned them as a necessary tool for businesses that already relied on these platforms.

Why it worked: By integrating with popular accounting software, Float made itself visible to users who were actively involved in financial management and in need of a reliable forecasting tool. Through this strategic partnership, Float gained credibility and access to potential customers within the platforms' ecosystems, reducing the effort needed to educate the market about their product.

Advocacy at Events and Conferences

Float's leadership, including CEO Colin Hewitt, participated actively in industry events like QBConnect. They also launched Float on platforms such as QuickBooks' online accountant program, elevating their visibility among accountants and financial professionals.

Why it worked: Events and conferences allowed Float to directly engage with key decision-makers and influencers in the accounting and financial sectors. By presenting at these gatherings, they created awareness and credibility, encouraging industry professionals to consider Float as a valuable tool for their clients or businesses.

Targeted Content and Podcast Appearances

Colin Hewitt frequently engaged in podcast interviews, blog posts, and other content-driven platforms to discuss the importance of cash flow forecasting and how Float simplifies the process. This content served both as educational material for potential users and as a marketing channel for the business.

Why it worked: By focusing on content that addresses pain points related to cash flow forecasting, Float positioned itself as a thought leader in the industry. This strategy helped build trust and provided a platform to discuss complex financial issues in an accessible manner, attracting potential customers who were in search of solutions to their cash flow challenges.

What's the pricing strategy for Float?

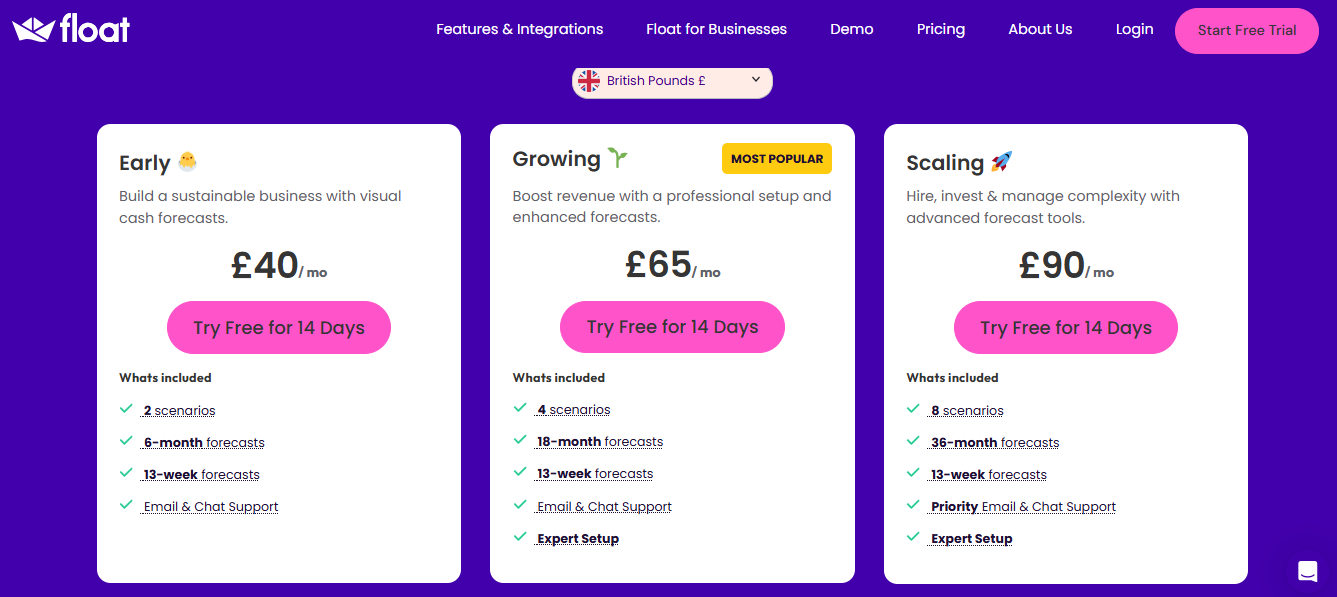

Float employs a tiered pricing strategy with its cash flow forecasting software, offering plans starting from $59 per month for small teams to $199 for larger enterprises, aiming to optimize cash management with real-time updates and scenario planning.

Float App Pricing

What were the biggest lessons learned from building Float?

- Focus on Product-Market Fit: Float's journey highlights the importance of iterating on your product until it truly meets customer needs. They spent significant time honing their cash-flow tool to ensure it was reliable and scalable for small businesses.

- Hire Specialized Roles: Initially, overlapping roles can slow down a startup. Float realized the value of hiring a dedicated product manager, which brought a more structured and efficient approach to product development.

- Culture Attracts Talent: Building a strong company culture can be a competitive advantage in attracting skilled employees. Float invested in fostering a workplace where people genuinely want to work, helping them attract talent in a competitive environment.

- Communicate Team Changes: Float experienced growth pains, especially in defining roles and responsibilities. They learned the value of clear communication when hiring new senior roles, ensuring alignment with company culture and values.

- Balance Features and Scalability: There's always a temptation to add new features, but Float learned to balance this desire with the need for a stable and scalable product. They focused on building a solid foundation before expanding functionalities.

Discover Similar Business Ideas Like Float

|

|

Idea

|

Revenue

|

|---|---|---|

|

PDFShift

|

HTML-to-PDF conversion API service.

|

$8.5K

monthly

|

|

SiteGPT

|

AI chatbot trained on your website content.

|

$15K

monthly

|

|

Hallow

|

"Catholic prayer and meditation app fostering faith growth."

|

$278K

monthly

|

|

tiiny.host

|

Static website hosting made simple for everyone.

|

$15K

monthly

|

|

Studio Wombat

|

WooCommerce plugin developer for enhanced e-commerce features.

|

$15K

monthly

|

|

Treendly

|

Trend-spotting platform for untapped market insights.

|

$1K

monthly

|

|

ScreenshotOne

|

API for capturing website screenshots easily.

|

$2.2K

monthly

|

More about Float:

Who is the owner of Float?

Colin Hewitt is the founder of Float.

When did Colin Hewitt start Float?

2012

What is Colin Hewitt's net worth?

Colin Hewitt's business makes an average of $/month.

How much money has Colin Hewitt made from Float?

Colin Hewitt started the business in 2012, and currently makes an average of .

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.