4 Digital Wallet App Success Stories [2024]

A digital wallet is a financial transaction application that runs on mobile devices. In today’s digital era, people demand the freedom to purchase anything and be able to pay from their digital wallets.

With technological advancement, making digital payments has become easier than ever before. Anyone can use mobile payment platforms to pay and accept payments online. Therefore, creating a digital payments wallet can be a great business opportunity.

To create a digital wallet, conduct extensive market research and create a business plan. It would help if you could hire competent programmers to create a secure payment gateway.

In this list, you'll find real-world digital wallet app success stories and very profitable examples of starting a digital wallet app that makes money.

1. iCard ($18M/year)

Yavor Petrov, the CEO of iCard, and his co-founder Christo Georgiev, came up with the idea for their digital bank account alternative back in 2007. They wanted to innovate and redefine card payments, making them more accessible and affordable. They built a real-time transaction processing system integrated with major card schemes, and since the launch in 2017, the iCard app has gained around 500,000 downloads and is used by people in over 30 European countries.

How much money it makes: $18M/year

How many people on the team: 200

iCard is a leading e-money institution that offers a unique and 100% digital bank account alternative, with their app and services supporting the daily payments of people in over 30 European countries, and since launch in late 2017, the iCard app has seen around 500,000 downloads.

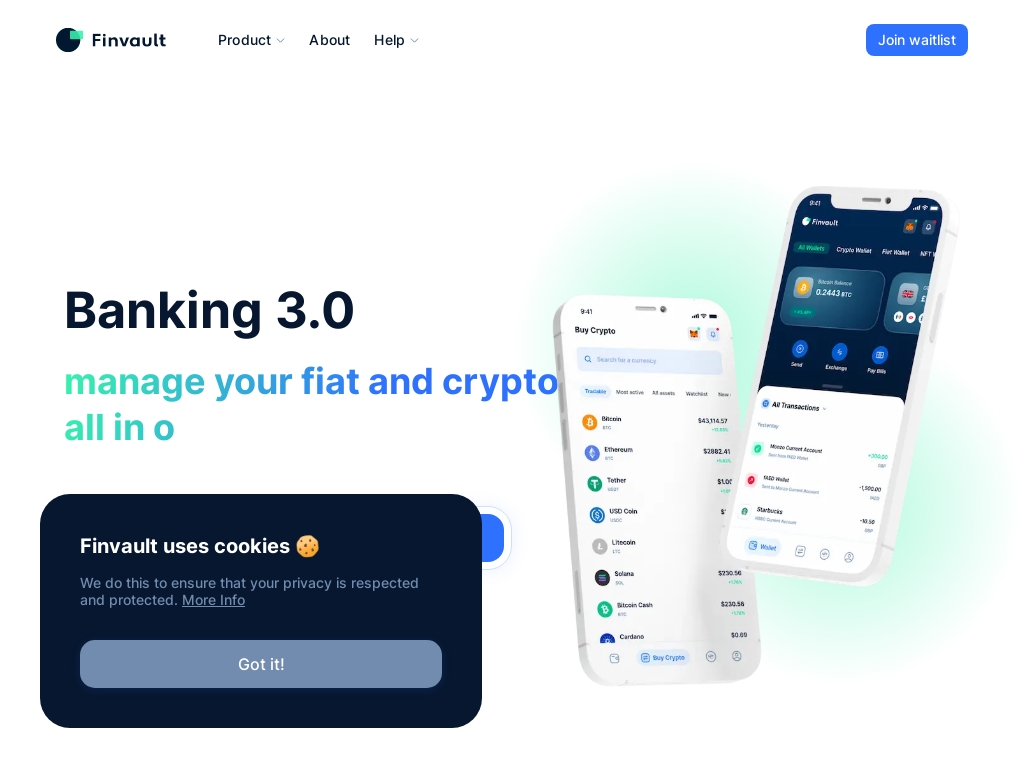

2. Finvault ($2.64M/year)

Punit Thakker, the CEO and co-founder of Finvault, came up with the idea for the digital wallet after recognizing the need to bridge the gap between traditional finance and decentralized finance (DeFi). With a background in fintech and cybersecurity, Punit and his co-founder Christian Papathanasiou aim to create an equitable financial ecosystem by providing a platform that allows users to manage all their bank accounts and crypto in one place. They have built a skilled team of developers and designers to bring their idea to life and are preparing for a phased launch into the UK and European markets.

How much money it makes: $2.64M/year

How much did it cost to start: $700K

How many people on the team: 13

Finvault co-founder Punit Thakker discusses the digital wallet's mission to financially connect users worldwide by providing one platform to manage all bank and crypto accounts; the platform is due to launch with initial features, including a crypto exchange, and is projected to achieve a customer acquisition cost of $10.75 and lifetime value of $4,800 based on a two-year lifecycle assumption.

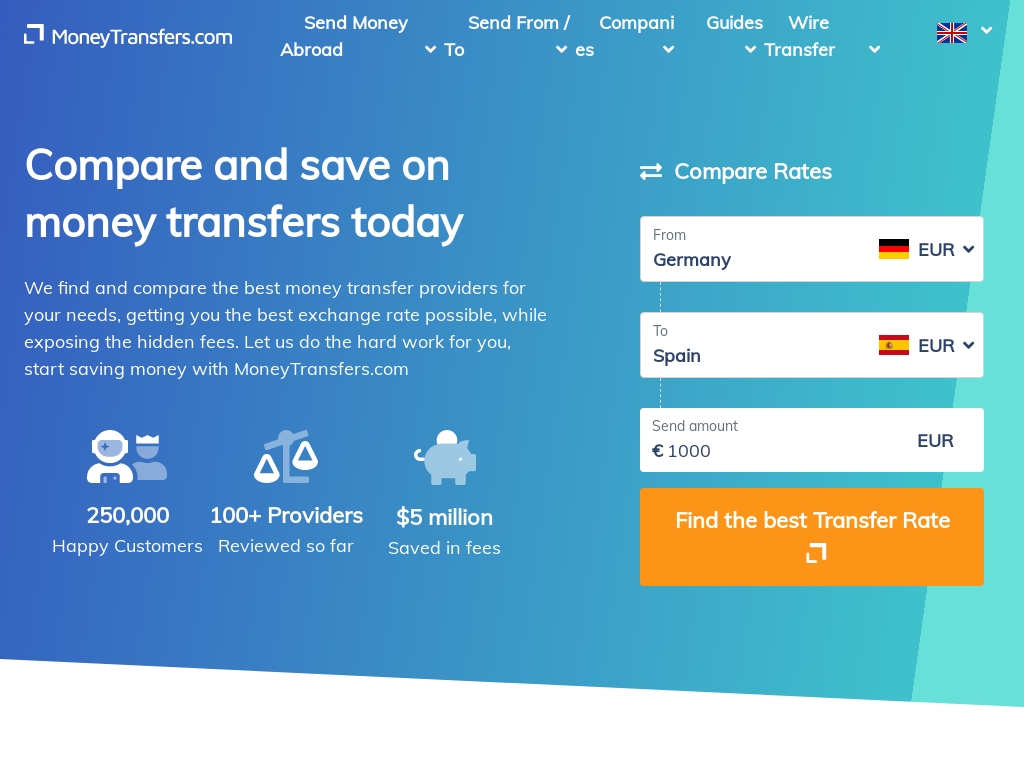

3. MoneyTransfers.com ($138K/year)

Jonathan Merry, founder of MoneyTransfers.com, came up with the idea for his business after experiencing the confusing and opaque world of online remittances firsthand. He realized there was a gap in the market for a money transfers comparison site that would provide users with transparent and affordable options. Since its launch in 2019, MoneyTransfers.com has generated an average monthly revenue of £2.5m and has become a trusted brand in the industry.

How much money it makes: $138K/year

How many people on the team: 12

MoneyTransfers.com is a comparison website which has grown to generate average monthly revenues of £2.5m and 2,500 new customers for partners each month since founder Jonathan Merry took the plunge in 2019; despite only experiencing organic acquisition in the last year, the company's solid traffic and range of digital PR campaigns aimed at the expat community have contributed to the company's establishment as a trusted brand in the money transfers space.

4. HoneyCoin ($12K/year)

David Nandwa founded HoneyCoin after experiencing frustration with payment platforms that were expensive, had restrictions for young people, and had unfriendly user experiences. He also saw the potential for independent creators in Africa to make significant earnings and wanted to create a platform that catered to their needs. HoneyCoin is now profitable and will be raising capital to handle increased demand after its public launch.

How much money it makes: $12K/year

How much did it cost to start: $150

How many people on the team: 0

HoneyCoin is a payments app that helps creators and internet businesses monetize their audiences by managing cash and cryptocurrency all in one place, which processes an average of $10k per month in revenue and has onboarded 504 people.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.