The Top 19 VC Firms In Utah [2025]

Are you looking for a VC firm for your Utah based startup?

Finding the right investment firm for your startup can be a daunting task.

There are a number of successful venture capital firms in Utah, and we've curated a list of the best local firms in the area. Additionally, we provide you with:

- Investment size

- Funding stages

- Typical industries the firm works with

- Well known companies the VC firm has invested in

Here's the list:

1. Park City Angels

- Location: Park City, UT

- Industries: Technology, Bioscience

- Investment Range: $10k - $1.5M

- Stage: Seed Stage

- Companies invested in: CommSafe AI, The Artemis Fund, Skill struck, Sigo Seguros, Paleblue, Certus Critical Care, Literal, Joule.

Park City Angels look to invest in early-stage companies that have shown promising potential in terms of shareholder returns.

The VC firm facilitates unique, high-caliber networking and development forums for angel investors and mentors to help startups.

Park City Angels primarily focuses funding on technology and bioscience companies.

Learn more about Park City Angels ➜

2. Banyan Ventures

- Location: Holladay, UT

- Industries: Manufacturing, business services, construction, and other industrial sectors

- Investment Range: $1M - $6M

- Stage: Seed Stage

- Companies invested in: Restore, DegreeOne, Mobilityre, Cellagain, Kore, Intermountain, Spruce, Graywhale.

Banyan Ventures invests in early-stage companies, providing the growth capital needed to build successful enterprises.

The VC firm provided investments in the range of $1M - $6M and targets companies in manufacturing, business services, construction, and other sectors.

This firm provides funding and helps the companies to set up a winning management team.

Learn more about Banyan Ventures ➜

3. DW Healthcare Partners

- Location: Park City UT.

- Industries: Healthcare

- Investment Range: $20M - $60M

- Stage: Seed Stage

- Companies invested in: Pentec Health, Bio Agri Mix, Hydrafacial, 360 Behavioral Health, Aequor, Champion, Cefaly.

DW Healthcare Partners seeks to collaborate with the best in class mid to late-stage companies focusing on healthcare.

The VC firm makes investments in the range of $20-$60 Million.

Apart from financial investments, their investment team brings a breadth of knowledge and operational expertise across multiple healthcare sectors.

Learn more about DW Healthcare Partners ➜

4. Epic Ventures

- Location: Salt Lake City, Utah

- Industries: Technology

- Investment Range: ~$500K - $2M

- Stage: ~Seed Stage

- Companies invested in ~Adaptive Computing, Ancestry, Artifact

EPIC focuses on technology startups that support the internet and software programming.

They are an early-stage software VC firm whose mission is to back entrepreneurs with innovative technology solutions.

They typically invest anywhere from $500K to $2M.

Learn more about Epic Ventures ➜

5. Kickstart Seed Fund

- Location: Cottonwood Heights, UT

- Industries: SaaS, Consumer, Edtech, Hardware, Software, Marketplace, and Healthcare

- Investment Range: ~$500K - $1M

- Stage: ~Seed Stage

- Companies invested in: ~Converus, Grain, Grow

Kickstart Seed Fund is an early-stage VC firm that focuses on SaaS, Consumer, Edtech, Hardware, Software, Marketplace, and Healthcare Startups for their potential growth.

Kickstart is more likely to invest in companies based in Utah, Colorado, and the Mountain West region.

They invest between $250K and $1M initially.

Learn more about Kickstart Seed Fund ➜

6. Pelion

- Location: Salt Lake City, UT

- Industries: Technology

- Investment Range: ~$2M - $6M

- Stage: ~Seed Stage

- Companies invested in: ~Firefly, Astound, MX

Pelion works with technology startups to build innovative and disruptive businesses and is marked as a valuable partner.

This early-stage VC firm supports software and cloud services businesses to move progressively through each stage of development.

Their typical investments range from $2M to $6M at the initial stage.

7. Album VC

- Location: Lehi, UT

- Industries: Technology

- Investment Range: ~$250K - $1M

- Stage: ~Seed Stage

- Companies invested in: ~Jolt, Divvy, Weave

Album VC, formerly known as Peak Ventures focuses on technology startups for the future of technology and culture.

Album VC is a seed-stage technology VC firm whose mission is to support the brightest and talented minds in shaping new technologies in different sectors.

Their typical investment range is between $250K - $1M.

8. Zetta Venture Partners

- Location: Salt Lake City, UT

- Industries: Technology

- Investment Range: ~$1M - 5M

- Stage: ~Seed Stage

- Companies invested in: ~Aptology, Clearbit, Dor

Zetta Venture Partners focuses on AI-first Startups with B2B business models to support them in establishing customer traction for AI products.

Zetta Venture Partners, an early-stage VC firm, promotes software development that analyzes data to predict and prescribe optimal outcomes.

They typically invest anywhere from $1M to $5M at the stage.

Learn more about Zetta Venture Partners ➜

9. Mercato

- Location: Cottonwood Heights, UT

- Industries: Technology and Consumer Goods

- Investment Range: ~$7M - $15M

- Stage: ~First Stage

- Companies invested in: ~Galileo, Crack Shack, Blip

Mercato is a Cottonwood Heights-based VC firm that focuses on technology and consumer goods businesses at their growing stage and helps them to grow faster.

Mercato has built four different practices- traverse, alpha, prelude, and savory to support talented entrepreneurs and growing companies across different stages with collaborative investments.

They typically invest anywhere from $7M to $15M.

10. Alta Ventures

- Location: Mexico, Lehi, UT

- Industries: Internet, SaaS Computing, Mobile Computing, Consumer, Security, Communications and Health Care

- Investment Range: ~$500K - $10M

- Stage: ~Seed Stage

- Companies invested in: ~Mappen, Murally, Converus

Alta Ventures is an early-stage firm providing seed, growth, and venture capital. Its area of focus is SaaS Computing, Mobile Computing, Internet, Consumer, Security, Communications, and Health Care.

Alta supports enthusiastic entrepreneurs to grow innovative companies and reach new heights.

Their investments range from as little as $500K to as much as $10M.

Learn more about Alta Ventures ➜

11. 42 Ventures

- Location: Salt Lake City, UT

- Industries: Technology and Software

- Investment Range: ~$250K - $1.5M

- Stage: ~Seed Stage

- Companies invested in: ~Distribion, Fast, Touchpath

42 Ventures focuses on software-driven businesses that have growth potential and domain expertise.

This SalyLake City-based early-stage VC firm partners with entrepreneurs who have expertise in innovative products and services to defined markets.

They invest between $250,000 and $1.5 million in a typical deal.

Learn more about 42 Ventures ➜

12. Peterson Partners

- Location: Salt Lake City, UT

- Industries: Fintech, Technology, Healthcare, Retail & Consumer, Manufacturing, Transportation

- Investment Range: ~$250K - $1M

- Stage: ~Seed Stage, Startup Stage, and First Stage

- Companies invested in: ~Allbirds, Azul, Solidcore

Peterson Partners is a privately-held VC firm in Salt Lake City that focuses on fintech, SaaS, digital commerce, consumer-tech, business services, healthcare, software & internet, retail & consumer, manufacturing, transportation, and industrials sectors.

The company looks to invest in pre-seed, seed-stage, growth-stage companies and also through means of buyouts, and co-investments.

Their investments range in size from as little as $250K to as much as $1M.

Learn more about Peterson Partners ➜

13. Signal Peak Ventures

- Location: Salt Lake City, UT

- Industries: Technology and Life-Sciences

- Investment Range: ~$250K - $10M

- Stage: ~Seed Stage

- Companies invested in: ~Degreed, Keap, Ancestry

Signal Peak Ventures is a Salt Lake City-based VC firm that primarily invests in early-stage technology companies dealing in sectors like SaaS, BioTech R&D, Diagnostics, and AdTech.

They mainly focus on industries like Life Science & Medical Technology, Information Technology & Networking and look for founders who are passionate to bring significant changes in these fields.

The firm's investments range varies from as little as $250K to as much as $10M.

Learn more about Signal Peak Ventures ➜

14. Crocker Ventures

- Location: Salt Lake City, UT

- Industries: Biotechnology, Health Care and Pharmaceutical

- Investment Range: ~$10M - $50M

- Stage: ~Seed Stage

- Companies invested in: ~Clene Nanomedicine, Merrimack Pharmaceuticals, Xenocor

Crocker Ventures, a privately held firm, invests in Life Science, Healthcare, and High-Technology to identify the growth potential and market needs.

They are an early-stage VC firm whose primary areas are biotechnology/pharmaceuticals, medical devices, drug delivery, diagnostics, and information technology.

The firm typically invests anywhere from $10M to $50M.

Learn more about Crocker Ventures ➜

15. RenewableTech Ventures

- Location: Salt Lake City, UT

- Industries: Renewable Energy and Clean Technology

- Investment Range: ~Not Disclosed

- Stage: ~Seed Stage and First Stage

- Companies invested in: ~Solid Carbon Products, watertonpolymer.com, Consolidated Energy

RenewableTech Ventures is a VC firm based in Salt Lake City that supports Cleantech startups of the US and Canada Region.

The firm focuses on transportation, energy, manufacturing, infrastructure, advanced materials, IT, and agriculture.

RenewableTech Ventures has been founded in 2010 and helped dozens of successful companies in this sector.

Learn more about RenewableTech Ventures ➜

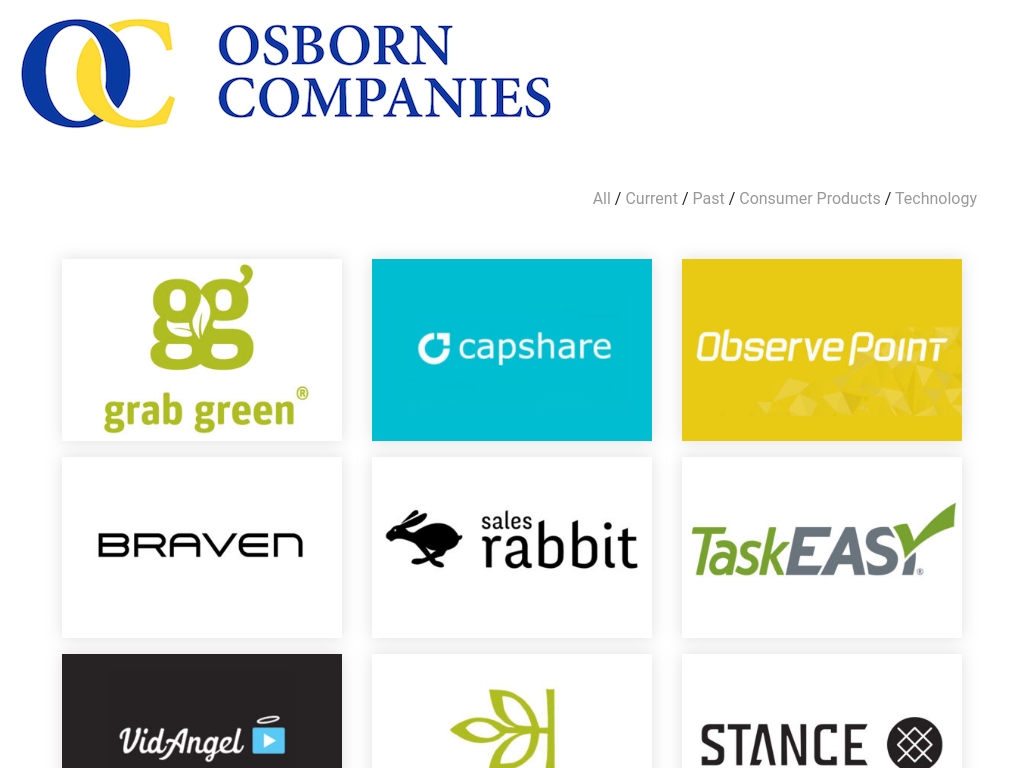

16. Osborn Companies

- Location: Provo, UT

- Industries: Consumer Products, Technology

- Investment Range: Not Disclosed

- Stage: Series A

- Companies invested in: Grab Green, Capshare, Braven, TaskEasy, Sales Rabbit, Observe Point, Vid Angel, Ancestry.com, Stance.

Osborn Companies invests in Series A companies focusing on technology and consumer products.

In addition to funding, the VC firm provides companies with insights into product design, innovation, and product development.

The investors believe in innovative ideas and thus partner with creative & innovative entrepreneurs who are driven to be the world's best.

Learn more about Osborn Companies ➜

17. Frazier Group

- Location: Lewi, UT, Idaho, Washington, California, Nevada, Arizona, New Mexico, Texas, and Colorado

- Industries: Technology, Healthcare

- Investment Range: Not Disclosed

- Stage: Seed Stage, Series A

- Companies invested in: Galileo, Homie, DoMo, Degreed, Truvision, Stance, Techstyle, Soffi, Saltstack, Marketwire

Frazier Group focuses on seed-stage and series A companies within the technology and healthcare sectors but remains open to other sectors as well.

The VC firm has been funding companies for over 25 years and invested in over 100 companies.

Frazier makes investment decisions in a few days rather than taking weeks or months.

Learn more about Frazier Group ➜

18. Clarke Capital Partners

- Location: Provo, UT

- Industries: IP Transactions, Finance, Insurance

- Investment Range: Not Disclosed

- Stage: Seed Stage

- Companies invested in: PX.com, Vio.petcare, Brandless, Advanced.farm, Gigaio, PetPremium, Posh, Curza, Contour IP.

Clarke Capital Partners invests in levered buyouts and intellectual property portfolios. The VC firm believes in building Intellectual Property for their portfolio companies.

Therefore, they offer specialized teams to build, defend, and enforce IP assets.

Clarke Capital Partners leverages expertise while focusing on ensuring profitable and sustainable growth.

Learn more about Clarke Capital Partners ➜

19. KEB Enterprises

- Location: Grove, UT

- Industries: Business Development financial services

- Stage: Seed Stage

- Companies invested in Alpine Air Express, Pharmatech, Lehi Mills, ESM, Liquids, Elements of health care.

KEB Enterprises specializes in helping each business achieve its long-term success and growth.

The VC firm provides unique resources and an experienced team to strengthen and enhance the businesses KEB enterprises have interests in.

The Firm has interests in business development, finance, and financial services.

Learn more about KEB Enterprises ➜

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.