We Found The Best Bank For Your Startup (2024)

Banking is the lifeblood of any business. It's the way you pay your bills, keep track of your cash flow and make sure your money is secure.

The right banking partner can help your business grow faster and help you become more profitable. But with so many banking solutions out there, how do you know which one is best for your business?

Mercury is changing how startups of all sizes manage their finances. In this article, we'll explain 3 reasons startups love Mercury and what makes them our preferred solution for small business banking.*

Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group and Evolve Bank & Trust®; Members FDIC. The Mercury Debit Cards are issued by Choice Financial Group and Evolve Bank & Trust, Members FDIC, pursuant to licenses from MasterCard. The IO Card is issued by Patriot Bank, Member FDIC, pursuant to a license from MasterCard.

What is Mercury?

Mercury is an online banking platform designed for startups of all sizes. The platform provides checking and savings accounts to help startups grow and manage their capital.

Mercury makes tedious banking tasks simpler, more intuitive, and even a little enjoyable.

It's completely free to sign up and takes only 10 minutes. But wait - there's more. They are giving Starter Story readers $150 in cash when you sign up.

Mercury is an absolute no-brainer solution for your banking needs.

Here are 3 reasons why:

Reason 1: No hidden fees

If you're a startup or small business owner, it's important to understand what fees your bank will be charging you. Because if you don't—or if you don't know how to negotiate them—they could cost you thousands of dollars over time.

Some banks charge a monthly fee just for having an account, while others will charge fees on certain transactions or services.

As a business owner, the last thing you want to be worrying about is whether your bank is going to charge you $25 for every check you write—or $10 for every ATM withdrawal.

With Mercury, you get all the benefits of a traditional business bank—including ATM access, checkbooks, debit cards—but with zero monthly fees.

| Mercury fees at a glance | |

|---|---|

| Account Types | Free checking & savings |

| Minimum opening deposit requirement | $0 (both checking & savings) |

| Monthly account or transaction fees | $0 (e.g., monthly fees or overdraft fees) |

| ACH transfers, domestic wires, and USD international wires | $0 to send and receive |

| Virtual debit cards | Free to issue to anyone on your team |

| Currency exchange | 1% fee |

| Interest on treasury accounts | 2% interest |

Reason 2: Quick, no-nonsense application process

The best banking option for your startup will be one that has a quick and easy application process, makes it easy to open an account without a lot of paperwork, and is willing to work with you as your business grows.

That's why startups love Mercury. It takes less than 10 minutes to apply, and no more than 5-7 business days to get approved.

Best of all, they have very few requirements to open an account - which is why startups of all sizes love them. You don't need loads of paperwork, set financial goals, and money in the bank to get started.

Documents to have ready:

Business formation docs (e.g certificate of incorporation or articles of organization)

IRS-issued EIN document

US government ID or international passport

Apply for an account in 10 minutes ➜ .

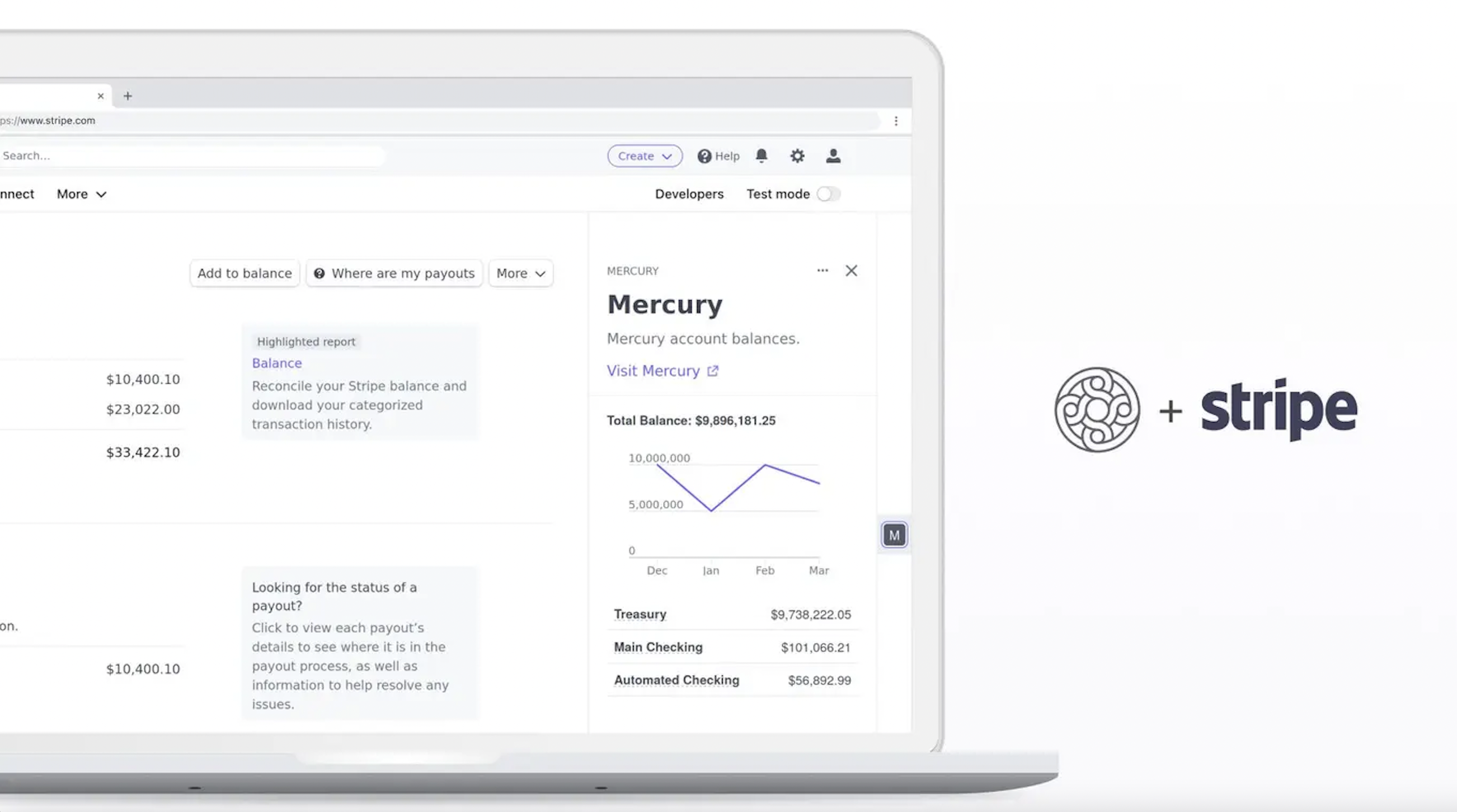

Reason 3: So much more than a place to keep your money.

Your business account isn't just where you keep your money. It's where you manage it, too.

The tools in your online account are an essential part of that management process.

With Mercury, you get all of what you expect and plenty of what you don’t:

- Functionality: Easily designate each account for a different function of your business, like operations/payroll, AP, or AR.

- API: Save time with seamless integrations, from Quickbooks to Stripe and more.

- Virtual Cards: Scale your account by issuing virtual cards to your growing team in seconds.

- Track your goals: Use auto-transfer rules with advanced sweep conditions to help you stay on budget, transform workflows with read/write API access, and take advantage of tiered user permissions to enable custom team management.

- Investor community: If you’re gearing up to fundraise, Mercury Raise can help you make direct connections with quality investors.

Final Thoughts

Overall, Mercury is our preferred online banking solution for startups. The features we outlined above make it an excellent choice for companies of all sizes.

To see what it’s like to use Mercury, give their free demo a spin.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.