Top 24 VC Firms In London [2025]

Are you looking for the best Venture Capital (VC) firm in London?

London is one of the top cities which has drawn investor attention with some of the biggest VC firms in UK, based here. It is also one of the best cities in the world for access to funding & quality of investment ecosystem. In 2021, VC investment in London startups soared to over $25 Bn, an all time high.

Overall, the London startup ecosystem provides immense funding opportunities for early stage as well as established startups.

While the needs of these new startups are as diverse as the products and solutions they offer, they all value connections with industry support through funding that can aid their venture to market.

VC firms in London offer good investment and provide startups business management approach, resources, and extensive networking opportunities.

However, finding the right investment firm for your startup can be a daunting task.

To make this task simpler, we have curated a list of 24 successful venture capital firms in London. Additionally, we provide you with their:

- Investment size

- Funding stages

- Typical industries the firm works with

- Well known companies the VC firm has invested in

Here's the list of Top VC Firms in London:

| # | VC | Funding | Stage | More |

|---|---|---|---|---|

| 1 | Seedcamp | £200K - £750K | Pre-Seed and Seed-Stage | More |

| 2 | Octopus Ventures | $1 Million -$10 Million | Seed-Stage, Series B | More |

| 3 | Index Ventures | $100K - $1 Million | All Stages | More |

| 4 | Ascension Ventures | $10M - $15M | Seed Stage | More |

| 5 | Balderton Capital | $1 Million - $20 Million | Seed Stage and Growth Stage | More |

| 6 | SFC Capital | $100k - $300k | Seed Stage | More |

| 7 | MMC Ventures | £25K - £3M | Seed Stage | More |

| 8 | Accel Partners | $50M - $75M | Seed Stage, Series A, Series B | More |

| 9 | BGF Growth Capital | £1M - £15M | Seed Stage | More |

| 10 | Playfair Capital | £100k - £500k in round sizes of up to £3m. | Seed Stage | More |

| 11 | Forward Partners | £200k - £2M | Seed Stage | More |

| 12 | Notion Capital | $2M - $10M. | Seed Stage | More |

| 13 | Beringea | $2M-$10M | Seed Stage, Series A | More |

| 14 | Connect Ventures | $450K - $2.6 Million | Seed Stage | More |

| 15 | Draper Esprit | £2M - £50M | Series A, Series B | More |

| 16 | IQ Capital | £500K - £30M | Seed Stage, Series A, Series B. | More |

| 17 | Calculus Capital | Not disclosed | Seed Stage | More |

| 18 | Passion Capital | Not Disclosed. | Seed Stage | More |

| 19 | LocalGlobe | Not Disclosed. | Seed Stage | More |

| 20 | Fuel Ventures | Not disclosed | Seed Stage | More |

| 21 | Downing Ventures | Not disclosed | Seed Stage | More |

| 22 | AlbionVC | Not disclosed | Late Stage To Series B | More |

| 23 | Anthemis Group | Not disclosed | Seed Stage | More |

| 24 | Force Over Mass | Not disclosed | Seed Stage | More |

1. Seedcamp

- Location: London

- Industries: Technology

- Investment Range: £200K - £750K

- Stage: Pre-Seed and Seed-Stage

- Companies invested in: Revolut, Sorare, Hopin, Wefox Group, Skew, Maze, Harbr, Primer, Wise.

- No. of Investments made : 299

- No. of Portfolio Exits : 48

Seedcamp invests in pre-seed and seed-stage companies, providing financial and human capital to help startups compete effectively.

The venture capitalist leads the pre-seed round with an investment of between £200K - £750K in exchange for an ownership stake between 6-7%. For seed-stage investments.

The VC firm is sector agnostic and focuses on backing world-class founders creating valuable, technology-focused businesses for sufficiently large addressable markets.

2. Octopus Ventures

- Location: London, New York

- Industries: Fintech, Health, Deep Tech, Consumer, B2B Software.

- Investment Range: $1 Million -$10 Million

- Stage: Seed-Stage, Series B

- Companies invested in: Secret escapes, Ibex, Ultrasoc, Zynstra, SwiftKey, WaveOptics, AudioTelligence, Memrise.

- No. of Investments made : 335

- No. of Portfolio Exits : 46

Octopus Ventures focuses on health, fintech, deep tech, consumer, and B2B software companies.

Apart from financial support, the venture capitalist commits time and energy to see that the companies they have invested in excel. Octopus Ventures invests in seed-stage and Series B companies that have shown the maximum potential for growth, innovation, and impact.

Typical investment starts from $1 Million for Seed to $10 Million for Series B

Learn more about Octopus Ventures ➜

3. Index Ventures

- Location: Australia, London, San Francisco, Geneva

- Industries: All Sectors

- Investment Range: $100K - $1 Million

- Stage: All Stages

- Companies invested in: Dropbox,Roblox, ArthurAI, Etsy, Elastic, Adyen, Figma, glossier, Datadog, Trustpilot, Squarespace.

- No. of Investments made : 1033

- No. of Portfolio Exits: 216

Index Ventures works with entrepreneurs and their companies at every stage, and across every sector.

The VC firm will often invest between $100K and $2Million as a pre-venture investment in seed-stage companies. Investments at a later Stage depend on the business potential.

Learn more about Index Ventures ➜

4. Ascension Ventures

- Location: London, St Louis

- Industries: Healthcare

- Investment Range: $10M - $15M

- Stage: Seed Stage

- Companies invested in Academic Partnerships, Accretive Health, Aethon, Apama Medical, Arista MD, Bind, Augmenix.

- No. of Investments made : 268

- No. of Portfolio Exits: 35

Ascension Ventures is a strategic healthcare venture fund. The VC firm provides investments of up to $10 Million per round and up to $15 Million to companies in their early-stage or late stages of development.

Since its establishment, the firm has been keen on providing venture and growth equity investments for companies interested in healthcare information technology, medical devices, and diagnostics.

Learn more about Ascension Ventures ➜

5. Balderton Capital

- Location: London

- Industries: Technology

- Investment Range: $1 Million - $20 Million

- Stage: Seed Stage and Growth Stage

- Companies invested in: Adludio, Aircall, 3D Hubs, Andjaro, Arive, Bebo, Axitec, Betfair, Big fish Games.

- No. of Investments made : 393

- No. of Portfolio Exits: 71

Balderton Capital supports technology-focused companies at both the early-stage and growth stages. Balderton invested in companies that provide software solutions, communications, security, mobile computing, and consumer services. The VC firm remains committed to sharing its expertise with founders and entrepreneurs from early stage to exit.

The Balderton team comprises legal talent, finance, and marketing experts who offer advice to ensure expert service.

Learn more about Balderton Capital ➜

6. SFC Capital

- Location: London

- Industries: Food & Drink, Life Sciences, Media & Entertainment, Mobile & Online Solutions.

- Investment Range: $100k - $300k

- Stage: Seed Stage

- Companies invested in: Onfido, Cognism, Humanising Autonomy,Transcend Packaging, Bean, ScreenCloud.

- No. of Investments made : 377

SFC Capital focuses on early-stage firms within the sector of food & drink, life sciences, media 7 entertainment, online solutions, services, manufacturing, and science.

The VC firm is keen on investing in firms that combine the right entrepreneurial mindset to build successful companies that will deliver significant returns to investors and ensure a positive impact on the world.

SFC typically invests anywhere between $100k to $300k at the primary stage.

Learn more about SFC Capital ➜

7. MMC Ventures

- Location: London

- Industries: Technology

- Investment Range: £25K - £3M

- Stage: Seed Stage

- Companies invested in: Gousto, Signal AI, Current, Masabi, DigitalGenius, Qflow, Habitual, Small World, Synthesia, Senseon.

- No. of Investments made : 177

- No. of Portfolio Exits: 22

MMC Ventures primarily supports technology companies, and initially makes an investment between £25K and £3M, with an exit horizon of 3 to 5 years.

The VC firm has over $500 million under management, within companies that are transforming industries, innovating with nascent, and companies within fast-evolving technologies like artificial intelligence and Blockchain.

Learn more about MMC Ventures ➜

8. Accel Partners

- Location: Sydney, London, Palo Alto, CA, Bengaluru, India, Karnataka, India

- Industries: Technology

- Investment Range: $50M - $75M

- Stage: Seed Stage, Series A, Series B

- Companies invested in: 1Password, Ada, Algolia, Away, BlackBuck, Chainalysis, BrowserStack, Checkr, Cognite, Cohesity, Ethos.

- No. of Investments made : 1793

- No. of Portfolio Exits: 349

Accel Partners provides investment capital to both early-stage and growth-stage companies working in the technology sector. The VC firm helps global entrepreneurs by providing funding and helping entrepreneurs through business decision-making.

Their investments range is $50M - $75M, and the company brings decades of experience in building and supporting companies.

Learn more about Accel Partners ➜

9. BGF Growth Capital

- Location: London, Dublin

- Industries: Multi-sectors

- Investment Range: £1M - £15M

- Stage: Seed Stage

- Companies invested in: Paintbox, eflex, Prodrive, Agile Spray Response, BF1systems, Orbex.

- No. of Investments made : 370

- No. of Portfolio Exits: 65

BGF Growth Capital supports entrepreneurs and innovators who are powering the future of the economy. The VC firm funds early-stage startups with investments of between £1M and £15M. BGF exists to help businesses grow.

The firm also provides access to expertise and knowledge, ensuring the success of beneficiary companies.

BGF invests in advanced technology, artificial intelligence, automotive & aerospace, business services, E-Commerce, Education, and other sectors.

Learn more about BGF Growth Capital ➜

10. Playfair Capital

- Location: London

- Industries: Technology

- Investment Range: £100k - £500k in round sizes of up to £3m.

- Stage: Seed Stage

- Companies invested in: AeroCloud Systems, Heka, Koala, Nory, Omnipresent, Orca AI, Recycleye, Rensource, SensorFlow.

- No. of Investments made : 73

- No. of Portfolio Exits: 6

Playfair is an early-stage venture capital firm investing in companies that focus on the technology sector, including Fintech, Cybersecurity, marketplaces, remote working, Artificial Intelligence, Computer Vision, and so much more.

As a pre-seed and seed-stage VC firm, Playfair invests between £100k - £500k in round sizes of up to £3m.

Learn more about Playfair Capital ➜

11. Forward Partners

- Location: London

- Industries: Technology

- Investment Range: £200k - £2M

- Stage: Seed Stage

- Companies invested in: Ably, Ahauz, Airsupply, Applied AI, Big Health, Cazoo, ClickMechanic.

Forward Partners funds early-stage businesses focusing on eCommerce, Marketplace, and applied AI sectors.

Apart from funding, Forward Partners provides advice and on-demand execution support, while working closely to design, build and hire, to ensure beneficiary companies reach strategic goals faster.

The VC firm funds between £200k and £1 million for the pre-seed stage, and up to £2 million for Seed-stage funding.

Learn more about Forward Partners ➜

12. Notion Capital

- Location: London

- Industries: Technology

- Investment Range: $2M - $10M.

- Stage: Seed Stage

- Companies invested in: Acin, Adfenix, Adbrain, Apperio, Avrios, Brightpearl, Bryter, Currencycloud, Claims, dealflo, Demyst.

Notion Capital invests in companies focusing on SaaS and enterprise Technology.

The VC firm looks for founders with an elusive combination of qualities and supports them to ensure they become category-leading companies.

Their initial investment range is between $2M to $10M.

Learn more about Notion Capital ➜

13. Beringea

- Location: Detroit, MI, London

- Industries: Advanced manufacturing, Media, Retail, SaaS, Healthcare, Business services, and consumer.

- Investment Range: $2M-$10M

- Stage: Seed Stage, Series A

- Companies invested in: Popular Pays, Aistemos, Avid Ratings, Complion, Arctic shores, ATLAS Space Operations.

Beringea is a transatlantic venture capital seeking to invest in rapidly scaling entrepreneurial companies.

The VC firm typically invests between $2M-$10M in preferred equity. Focusing on fast-growing sectors, the VC firm prefers companies with promising revenue at the series A or at the small buy-out stage.

Beringea adds value through building leadership teams and providing strategic connections to their investees.

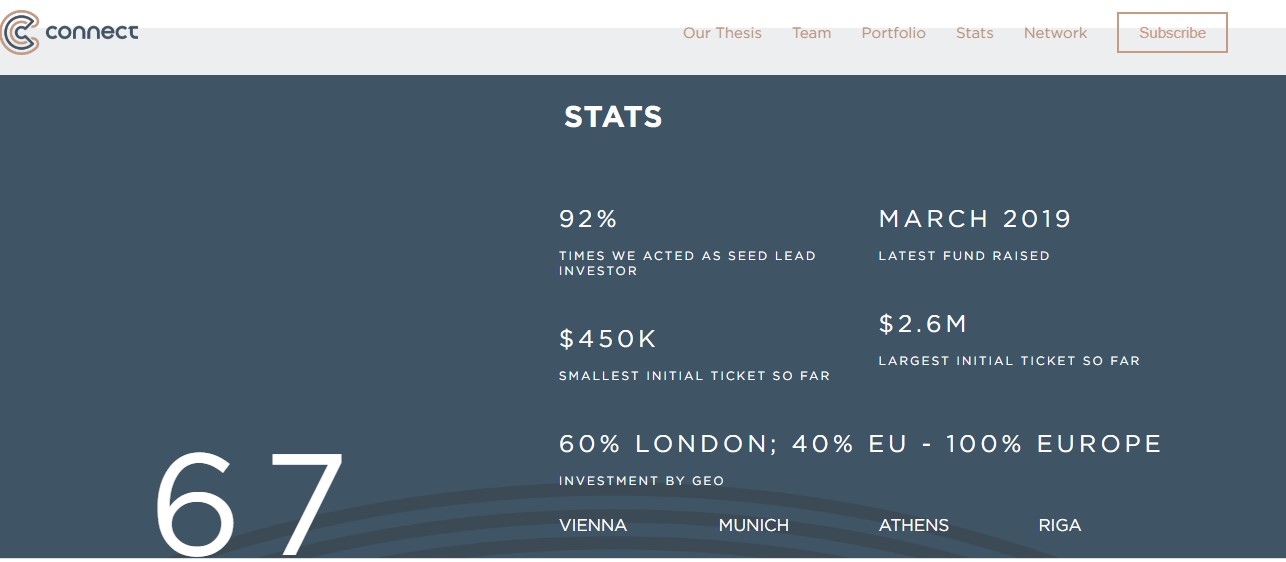

14. Connect Ventures

- Location: London

- Industries: Technology

- Investment Range: $450K - $2.6 Million

- Stage: Seed Stage

- Companies invested in: Detail, Deepstash, Progression, Contigent, Timeular, Woolf, Comma, Thursday, Superthread, Oyster, Emma.

Connect Ventures funds seed-stage startups and early-stage companies investing in product-led companies. The VC firm provides investments ranging between $450K and $2.6 Million. Connect ventures exists to add value to the founders and leadership teams of the companies they back.

Their core mission is to accelerate the learning curve of the founders and their team and to help them make better decisions.

In addition, the VC firm exits to ensure there is the right environment for them to build meaningful connections with their peers.

Learn more about Connect Ventures ➜

15. Draper Esprit

- Location: London

- Industries: Consumer, digital Health & Wellness, AI, DeepTech, Cloud, Enterprise, and SaaS

- Investment Range: £2M - £50M

- Stage: Series A, Series B

- Companies invested in: Cazoo, Perkbox, Revolut, Thought Machine, Graphcore.

Draper Esprit invests in the most promising high-growth technology companies at the series A and series B stages. The VC firm helps with strategy, finance, hiring, and international expansion strategy.

Draper Espirit is keen on funding the companies that see new ways for the world to work, and specifically those within the Consumer, digital Health & Wellness, AI, DeepTech, Cloud, Enterprise, and SaaS sectors.

The VC firm provides funding to the tune of £2M to £50M.

Learn more about Draper Esprit ➜

16. IQ Capital

- Location: London

- Industries: Technology

- Investment Range: £500K - £30M

- Stage: Seed Stage, Series A, Series B.

- Companies invested in: Concirrus, Thought Machine, Fluidic Analytics, Speechmatics, Privitar, M-Cube, Quantum, TurinTech.

IQ Capital invests in disruptive technology companies capable of dominating the global markets.

The firm is keen on funding Seed stage and Series A companies within the AI, Data Science, IoT, and other technology-based sectors.

IQ Capital invests up to £1.5 M for seed-stage ventures, £5M for Series A, and up to £30 for Growth stage ventures.

17. Calculus Capital

- Location: London

- Industries: Multi-sectors

- Investment Range: Not disclosed

- Stage: Seed Stage

- Companies invested in: eConsult, Spectral MD, Brouhaha Entertainment, Invizius, Arecor, Home Team content, Wazoku.

Calculus Capital invests £2Million to £5 million in entrepreneurial companies selling real products and services.

The VC firm executes in-depth due diligence of investment opportunities using an experienced investment team.

Their hands-on approach ensures they monitor performance, and effect changes where needed.

Learn more about Calculus Capital ➜

18. Passion Capital

- Location: London

- Industries: Technology

- Investment Range: Not Disclosed.

- Stage: Seed Stage

- Companies invested in: Adzuna, Mendeley, Bonfire, Smarkets, Picklive, Vicampo, Wedo, Pusher, Wine In Black, DueDil, Lulu, Eyeem, Mixlr, Tripbirds, Vinetrade, Loopcam.

Passion Capital invests in early-stage technology-focused startups.

The venture capitalist remains committed to fostering an ecosystem of technology and believes that the critical differentiator and key asset of a successful business is the passion and ability of its founders.

Learn more about Passion Capital ➜

19. LocalGlobe

- Location: London

- Industries: Technology

- Investment Range: Not Disclosed.

- Stage: Seed Stage

- Companies invested in: Equity Bee, Plum Guide, Goodlord, Empathy, Eden Life, Kano, Tide, Otta, Cleo, Wise.

Local Globe focuses on early-stage technology startups in SaaS and Artificial Intelligence. The VC firm offers financial assistance, and other technical expertise required to propel startups forward.

20. Fuel Ventures

- Location: London

- Industries: Technology

- Investment Range: Not disclosed

- Stage: Seed Stage

- Companies invested in: OneBuy.com, Volt, Heroes, Capdesk, Shift, MootGroup, Peckwater, Glorify, Beyonk, Outfund.

Fuel Ventures provides funding to early-stage and growth-stage companies focusing on technology.

The VC firm factors most ambitious entrepreneurs in the sectors covering globally scalable marketplaces, platforms, and Software

Learn more about Fuel Ventures ➜

21. Downing Ventures

- Location: London

- Industries: Technology

- Investment Range: Not disclosed

- Stage: Seed Stage

- Companies invested in: Abaka, Adaptix, Aday, ADCBIO, Arecor, Aventus, Avid Technology, AyarLabs, BridgeU, BBC Maestro.

Downing Ventures invests in early-stage and growth-stage companies focusing on deep technology, enterprise, and healthcare sectors.

The venture capital firm understands that these areas encompass the most interesting challenges within the digital world.

Therefore, the firm ensures support and remains open to ideas. They provide a skill set that goes deep into core sectors they invest in and help drive the companies forward.

Learn more about Downing Ventures ➜

22. AlbionVC

- Location: London

- Industries: Healthcare, B2B Software Solutions, and DeepTech

- Investment Range: Not disclosed

- Stage: Late Stage To Series B

- Companies invested in: Abcodia, Academia, Accelex, Anthropics, Active Hotels, Achilles Therapeutics, Arecor, Astroscreen.

AlbionVC focuses on early-stage companies within the healthcare, B2B Software solutions, and DeepTech.

The VC firm aims at empowering seed-stage companies, enabling them to create the businesses they want to lead.

Throughout the cooperation, the firm aims at building a strong relationship with the management team, offering an extensive experience and deep-rooted network of connections required to grow a scalable company.

23. Anthemis Group

- Location: London

- Industries: Fintech, Insurtech

- Investment Range: Not disclosed

- Stage: Seed Stage

- Companies invested in: Tide, Timetric, Tremor, TreasurySpring, Unmind, TrueLayer, Wayhome, Wollit, ZyFin, YuLife, Xapix.

Anthemis invests in technology-driven companies that focus on Fintech, Insurtech, and those that work towards changing the financial system.

The VC firm provides strategic and investment advice for financial services and technology companies, helping them to meet the demands of 21st Century consumers and businesses. Anthemis brings deep know-how and capabilities, ensuring the companies excel.

Learn more about Anthemis Group ➜

24. Force Over Mass

- Location: London

- Industries: SaaS, Security, EDTech, FinTech, InsurTech, Big Data & Analytics, Health & Bio.

- Investment Range: Not disclosed

- Stage: Seed Stage

- Companies invested in: A Million ADS, AI Build, AI XPRT, Action.AI, Admix, Apaleo, Bud, Banxware, Banked.

Force Over Mass supports companies and founders over multiple rounds.

They invest in the seed stage, series A, and Series B stages, delivering strong and consistent performance across funds.

The VC firm believes that success is driven by broad sourcing and ensuring a disciplined investment process.

By so doing, Force Over Mass Capital helps companies to scale effectively.

Learn more about Force Over Mass ➜

Reasons To Move Your Startup To London

London remains the melting pot of diverse cultures, talented professionals, and creative workspaces, and this is not by accident.

Here are some basic reasons to consider London as your next investment destination.

1. Londons Talented and Educated Workforce

London enjoys close proximity to excellent universities. For that reason, startups have a huge potential for attracting an educated cosmopolitan workforce.

2. Investors Are Everywhere

As London becomes more and more of a startup hub, Venture Capital investors are also targeting the city. The city attracts a great number of investors who are looking to pour their money into the next big companies.

3. London Offers Great Opportunities For Exposure

Investors and founders understand that exposure plays a critical role when it comes to startups growth.

Considering that London is home to leading online and in print publications, startups enjoy great potential when it comes to targeted advertising.

4. London’s Growing Community

If you are the kind of investor who thrives from having the innovation and motivation around you, then London is most certainly the place to invest.

Startups have access to shared workspaces, networking events, and meetings where investors bump into each other and exchange ideas.

5. It’s Easier Than you Thought

Do you know that the UK government actively encourages startups by offering financial support and entrepreneurship visas?

Here is an overview of the great business grants available in the UK.

Access to a talented workforce and multiple VC firms are some of the top reasons to consider launching your business in London.

How Does A VC Firm Work?

Venture Capital is a form of equity financing where investors fund a company in exchange for equity.

The firm or person making the investments is the venture capitalist. Therefore, the venture capitalist buys a stake in an entrepreneur's idea, nurtures the idea for a short period, before existing.

Note that a venture capital fund is not long-term investment. ideally, the venture capitalist invests in the company balance sheet until it reaches a certain size and credibility.

How Does A VC Firm Work?

Venture Capital is a form of equity financing where investors fund a company in exchange for equity.

The firm or person making the investments is the venture capitalist. Therefore, the venture capitalist buys a stake in an entrepreneur's idea, nurtures the idea for a short period, before existing.

Note that a venture capital fund is not long-term investment. ideally, the venture capitalist invests in the company balance sheet until it reaches a certain size and credibility.

What Are The Roles Of A Venture Capital Firm?

Typically, good venture capitalists in San Diego provide assistance to startups in many significant ways. The top five roles of VC firms include:

- General Partners: As general partners, the VC firm is responsible for all fund investment decisions and normally invest their capital in the fund.

- Venture Partners: The VC firm will source investment opportunities and they are paid based on the deals they close.

- Investment Principals: The VC firms take the mid-level investment-focused position, and have experience in investment banking or other experience relative to the fund investment strategy.

- Associates: Junior staff experienced in investment banking or management consulting.

- Entrepreneur-in-residence: They are industry experts hired as advisors or consultants to the venture capital firm temporarily, and often assist with due diligence or pitching new startup ideas.

What Are The Roles Of A Venture Capital Firm?

Typically, good venture capitalists in San Diego provide assistance to startups in many significant ways. The top five roles of VC firms include:

- General Partners: As general partners, the VC firm is responsible for all fund investment decisions and normally invest their capital in the fund.

- Venture Partners: The VC firm will source investment opportunities and they are paid based on the deals they close.

- Investment Principals: The VC firms take the mid-level investment-focused position, and have experience in investment banking or other experience relative to the fund investment strategy.

- Associates: Junior staff experienced in investment banking or management consulting.

- Entrepreneur-in-residence: They are industry experts hired as advisors or consultants to the venture capital firm temporarily, and often assist with due diligence or pitching new startup ideas.

What Does A Venture Capitalist Look for When Making an Investment?

VC firms look for a competitive advantage in the market. They are interested in their portfolio companies to be able to generate sales and profits before competitors enter the market. Therefore, before putting money into an opportunity, the VC firms want to know if the firm's management is up to the task, that the size of the market opportunity, and whether the product has what it takes to make money.

Ideally, all this is to reduce the riskiness of the opportunity.

What Does A Venture Capitalist Look for When Making an Investment?

VC firms look for a competitive advantage in the market. They are interested in their portfolio companies to be able to generate sales and profits before competitors enter the market. Therefore, before putting money into an opportunity, the VC firms want to know if the firm's management is up to the task, that the size of the market opportunity, and whether the product has what it takes to make money.

Ideally, all this is to reduce the riskiness of the opportunity.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.

Download the report and join our email newsletter packed with business ideas and money-making opportunities, backed by real-life case studies.